If you can’t make your mortgage payments and your home is upside down — meaning you owe more on the mortgage than the market value of the home — a short sale might be the best option for you.

A short sale transaction occurs when a homeowner, in the midst of a financial hardship, sells their property for a lower price than what they owe on their mortgage.

Because this differs from traditional real estate transactions where the borrower pays the entire debt, the mortgage lender must agree to the sale even though it means they won’t recoup the full loan amount. Although there is an approval process, this situation allows the homeowner and the lender to avoid a time-consuming foreclosure process, involving auctioning off the house.

If a short sale sounds like it could be the right option for you, contact us today. We work with a team of short sale negotiators and real estate professionals that specialize in negotiating short sales on behalf of Florida homeowners and our investment company as the buyer. Even if your property is scheduled to be sold at a foreclosure auction in a week, it is not too late. We can help you avoid foreclosure in Florida!

Short Sale Example

Imagine a homeowner has been unable to make house payments and has a mortgage balance of $200,000, but their house is only worth $180,000 on the current market. In a traditional sale, they wouldn’t be able to sell because they wouldn’t have enough money to pay off the loan after the sale.

However, through a short sale, they can find a buyer willing to pay $180,000. The lender would then agree to accept that amount as full payment on the loan, even though it’s a loss of $20,000. This allows the homeowner to sell the house and avoid the more serious consequences of foreclosure.

A major benefit of a short sale is it gives you the chance to negotiate a deficiency waiver with your lender. A deficiency judgment, which is basically a court order saying you owe the remaining balance after the sale, is allowed by Florida Statute 702.06. By negotiating a deficiency waiver in your short sale agreement, you can avoid the lender suing you for this leftover amount in the future, offering significant financial protection as you move forward.

Is a Short Sale Right for You?

A short sale may be your best option if:

- The property is worth less than what you owe the lender.

- You’re facing eligible financial hardship, like unemployment, bankruptcy, a health crisis preventing you from working, death of a spouse, divorce or separation or relocation by your employer.

- You have documents to prove your financial hardship and fill out the necessary short sale paperwork.

- Your lender is open to a short sale.

Even if foreclosure proceedings have already started, it’s worth reaching out to your lender to see if they might be open to a short sale. You’d need to include a hardship letter, among other documents, to explain your situation to them for missing those payments.

A lender may be willing to accept a short sale because the alternative is selling the house at auction, and it may not sell for a good price.

Having a real estate professional to guide you through the process and paperwork means you’re much more likely to get a good outcome. Florida Cash Home Buyers has connections to real estate professionals in Florida to help with this.

Short Sale Alternatives

Depending on your situation, there may be alternatives to a short sale, like a deed in lieu of foreclosure, a loan modification or forbearance. Make sure you’ve explored all the following options to determine the best fit for you.

- Deed in lieu of foreclosure: This allows you to voluntarily surrender your property deed to the lender to avoid foreclosure. It can be a good option if you owe a significant amount on your mortgage and a short sale isn’t feasible due to a lack of interested buyers. However, unlike a short sale, it likely won’t relieve you of the remaining loan balance.

- Loan modification: This involves negotiating with your lender to change the terms of your current mortgage, often lowering the monthly payment or interest rate. It’s ideal if you’re facing temporary financial hardship but can afford a modified mortgage payment over the long term.

- Forbearance: This is a temporary agreement with your lender to pause or reduce your mortgage payments for a set period. It can be a good option for short-term financial difficulties while you get back on your feet. However, the missed or reduced payments will eventually be added to your loan principal, increasing your future payments.

The Short Sale Process in Florida

If you’ve missed some mortgage payments or received a foreclosure notice, you may want to initiate the short sale process with the help of real estate professionals and your lender to avoid foreclosure.

Florida Cash Home Buyers works with a team of short sale negotiators and real estate professionals who specialize in negotiating short sales on behalf of Florida homeowners, and having our investment company as the buyer can help you with the process.

1. Contact your lender to understand your options

As mentioned earlier, you may be eligible for alternatives to a short sale like loan modification or forbearance. Contact your lender so you understand your options. If a short sale is the best choice, they can provide guidance on the documentation you need and how to proceed.

2. Work with a real estate professional to obtain and evaluate offers

Before your lender approves a short sale, they’ll want to see a competitive offer to ensure that they won’t lose more than they would if your house was foreclosed and sold at auction.

You can either hire a real estate agent experienced in Florida short sales or contact a trusted cash home buyer like us. We’ve navigated many successful short sales in Florida and have relationships with seasoned real estate market professionals who can help negotiate with your lender and help you through the process.

Contact Florida Cash Home Buyers today to receive a potential offer and get the ball rolling.

3. Prepare necessary documents

Short sales require a lot of documents. The requirements might vary from lender to lender, but you’ll need to fill them out and submit them. These documents detail the offer and provide additional information about your financial hardship.

Common documents needed for a short sale include:

- Hardship letter

- Purchase agreement

- Listing agreement

- Short sale application

- Proof of the buyer’s capability to buy the house

- Escrow instructions

- A letter of authorization

- A preliminary title report

- An estimated closing statement

- Tax returns from the last two years

- Proof of income

- Tax returns

- Mortgage statements and bank statements

4. Submit the offer to the lender and wait for a decision

The lender will also do their own financial analysis and may appraise the house, so expect for them to perform their due diligence to assess your situation. Fannie Mae and Freddie Mac lenders must respond to a submitted package within 30 days. If the offer is unacceptable, they have to respond with an acceptable counteroffer.

If the offer is accepted, the short sale must be closed within 60 days of being approved. This timeline may be slightly different for non–Fannie Mae or –Freddie Mac lenders.

Because of the lengthy timeline, it’s often best to keep the home listed for sale or have backup buyers in case the initial buyer falls through, so have backup buyers that you can reach out to.

5. Negotiate with the lender

After evaluating your short sale application, the lender may request additional documentation or counteroffer with an adjusted sale price.

Real estate professionals can help you navigate negotiations by trying to convince the buyer of the higher price, reaching out to backup buyers or listing the property on the MLS with the counteroffer price.

Remember, unless you get the deficiency judgment waived, you are liable for the difference between the sale price and the outstanding balance of your loan. And if your lender doesn’t approve the short sale and you can’t come to another agreement or get a high enough offer from a buyer, they might proceed with foreclosure.

6. Close the sale

If the short sale is approved by the lender, the sale closes very similarly to a typical sale. The mortgage is settled from the proceeds of the sale. However, if the deficiency balance wasn’t waived, you may owe money to your lender.

The sale could also have both tax and credit implications, which we’ll detail below.

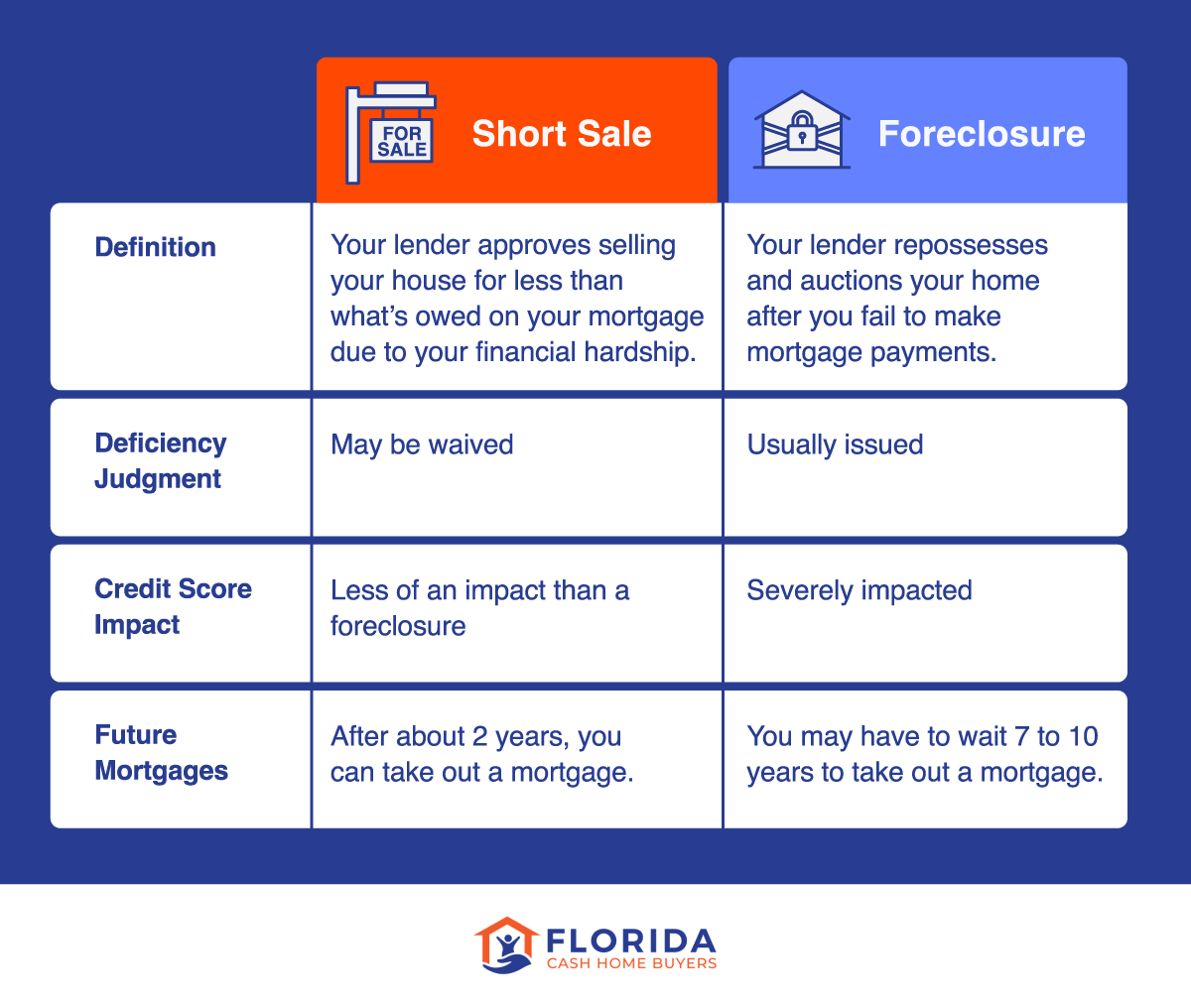

Short Sale vs. Foreclosure

If you’re wondering how a foreclosure differs from a short sale, here’s how it breaks down.

Short Sale

In a short sale, you won’t have your house forcibly taken from you. You can still live in it while the whole selling process happens. In fact, you’re part of the process, working with the buyer and real estate professionals to sell it.

While a short sale can stay on your credit report for up to seven years, it typically doesn’t have as much of a negative impact on your credit score as a foreclosure. However, the exact impact depends on your personal credit history, if you missed mortgage payments and if you still have a delinquency balance.

Also, you’ll likely be able to take out a new mortgage after about two years, rather than waiting seven to 10 years as you might have to with a foreclosure.

Foreclosure

A foreclosure is the worst-case scenario — your home is taken from you by the lender or bank because you haven’t made mortgage payments.

If you’ve missed four consecutive mortgage payments, then the foreclosure proceedings can begin, which severely impacts your credit. However, if you’re in pre-foreclosure, meaning that you’ve received a notice of default but the home hasn’t been repossessed yet, you may be able to pay the balance in full or proceed with a short sale.

Pros and Cons of the Short Sale Process

Short sales can offer a convenient exit from a difficult situation, but they’re not right for everyone. Here are some of the main advantages and disadvantages.

Pros

While a short sale means selling your property for less than you owe, it has its upsides:

- Avoids foreclosure: Escape the lengthy legal battle and severe credit score damage that comes with foreclosure.

- Deficiency could be waived: Negotiate with your lender to waive the deficiency judgment, potentially saving you from the remaining loan balance.

- Less credit damage than a foreclosure: Short sales typically have a less negative impact on your credit score compared to foreclosure, hurting your finances less in the long run and putting fewer limitations on your future options.

- Allows you to maintain some control: Maintain some control over the situation and potentially avoid the emotional turmoil of losing your home.

Cons

Short sales aren’t without their drawbacks:

- You have to gather a lot of documentation. Prepare for a significant paperwork burden, including a hardship letter, purchase contract, listing agreement, financial documents providing proof of income and assets and federal income tax returns. The upside is selling to Florida Cash Home Buyers because we can help you with the process and documentation.

- Your credit is negatively impacted. Although typically less severe than foreclosure, a short sale will still hurt your credit score.

- Lender approval is needed. With an agent, like Florida Cash Home Buyers, you’ll negotiate a sale then submit your offer to the lender. A short sale can’t move forward without the lender’s approval. Because a lender is likely to lose more money in a foreclosure auction, they’re likely to favor a short sale.

- It could be a lengthy process. Short sales can take up to a year to fully process with extensive paperwork and negotiations. With Florida Cash Home Buyers, we can make the process a lot quicker and less cumbersome by handling the cumbersome tasks, like that mountain of paperwork. Even if foreclosure is looming, you can still try to get your lender to agree to a short sale since they probably stand to lose more if they put your house up for auction after a foreclosure.

Short Sale FAQs

You have questions, we have answers. Here are answers to some of the most common questions about short sales.

Will You Still Owe Money After a Short Sale?

Unless it’s specifically determined in the short sale agreement between you and the lender, you will either have to pay back the remaining mortgage deficiency or it will be waived. However it’s decided, make sure it’s all in writing to ensure you don’t end up owing something you never agreed to.

What Are the Types of Short Sales?

There are several different types of short sales — like straight short sale, short sale with repayment and multiple short sales — depending on your situation.

- Straight short sale: This is the most common type. The lender agrees to accept the sale proceeds to settle the debt, even if it results in a deficiency. Ideal for homeowners with minimal savings or future repayment ability.

- Short sale with repayment: Here, the seller agrees to repay a portion of the deficiency balance to the lender in exchange for approval. This can be beneficial if you have some extra funds or future earning potential and want to minimize the credit score impact compared to a straight short sale.

- Multiple short sales: This is less common and involves selling more than one property through short sales to satisfy multiple mortgages. It’s a last resort option for homeowners facing financial hardship on multiple properties.

Will You Have to Pay Taxes on a Short Sale?

Yes, there’s a chance you’ll owe taxes on a short sale. The IRS considers forgiven debt as income, so the difference between what you owe and the sale price could be taxable. There is an exception for principal residence debt forgiveness up to $250,000 for married couples filing jointly, but it’s important to consult with a tax advisor to understand your specific situation.

Ready to Sell Your House?

Deciding on a short sale can be overwhelming, but you don’t have to go through it alone. Florida Cash Home Buyers has a team of short sale specialists ready to guide you through the process.

Our team negotiates with lenders on your behalf and leverages our experience as short sale property cash buyers to secure a swift and successful short sale, helping you move forward with financial peace of mind. Contact us today for a free consultation and see how we can help you navigate your situation.